The pecan industry faced many challenges and opportunities in 2024. With stable production forecasts and continued demand, the industry is expected to grow further in the coming years. The United States is a global leader in pecan production, crucial in cultivating, processing, and exporting pecans.

Pecan trees are native to North America, and the world's largest commercial pecan production occurs in the United States. The top producers are Texas, Georgia, New Mexico, and Arizona, while the southern and western states are the primary growing regions. Other states that contribute to the pecan business in the United States are Mississippi, Alabama, Louisiana, and Oklahoma.

Texas: Approximately 40% of the pecans produced in the United States come from this state, which is the top producer. Long growing seasons and plenty of sunshine are beneficial to the state's enormous orchards, especially in the central and western parts.

Georgia: Second in pecan output, Georgia is renowned for its perfect growing conditions. A thriving pecan farming sector is supported by the state's soil, climate, and infrastructure.

New Mexico: Especially in the southern portion of the state, New Mexico is a major producer of pecans due to its desert soil and arid environment.

Although there are variations because of market dynamics and environmental considerations, it is anticipated that U.S. pecan output will expand somewhat by the end of 2024.

Many pecan orchards have had difficulties like drought, disease, and poor weather, the 2024 pecan harvest is anticipated to be milder than in past boom years. However, because of better irrigation systems and farming practices, industry experts expect that the total production will be constant. Precision farming and pest control are two examples of agricultural technological innovations that have greatly increased yields and guaranteed high-quality output.

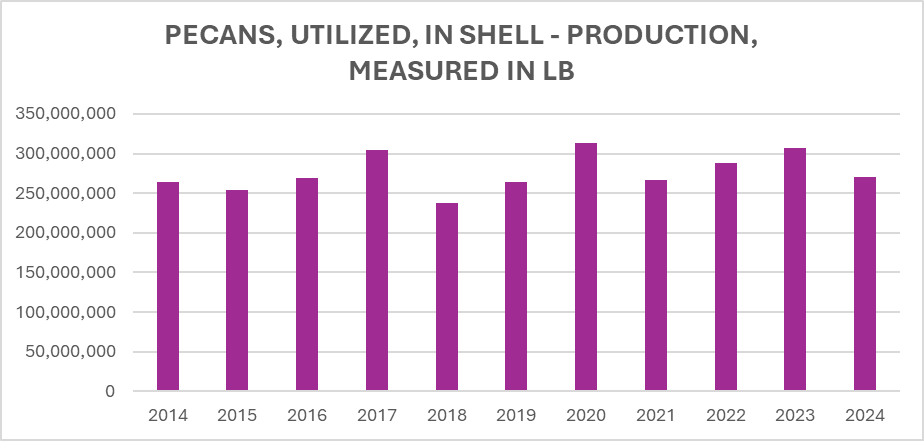

Source- https://quickstats.nass.usda.gov/results/252861DB-1E67-33A9-A8A1-B5ED7CD6C356

The annual production of in-shell pecans, measured in pounds, from 2014 to 2024, highlighting trends and fluctuations over the 11 years. Production reached its highest levels in 2017 and 2023, both exceeding 300 million pounds, marking the two peak years. In contrast, the lowest production occurred in 2018, dropping below 250 million pounds. While the overall trend shows relative stability, with most years maintaining production levels around or slightly above 250 million pounds, occasional fluctuations are evident. A notable recent decline is observed in 2024, where production levels fell closer to 250 million pounds after a significant high in 2023. This pattern reflects both consistency and variability in pecan production over the years.

The primary cause of 2024's lower pecan production was Hurricane Helene, which had a significant negative impact on Georgia and other important pecan-growing regions. The hurricane reduced yields by interfering with harvest procedures and seriously damaging crops. Even though preliminary surveys were carried out following the storm, the USDA stated that the entire extent of the damage might not yet be apparent. Furthermore, the situation has been made worse by more general industry issues like logistical constraints and market volatility.

Over 260 miles of pecan orchards were destroyed by Hurricane Helene's winds, which ranged from 82 to 109 miles per hour. Most of the damage was done to mature, bearing trees, many of which were uprooted or irreparably destroyed. Given how long it takes for pecan trees to mature, this damage is serious since it not only impacts this year's harvest but also puts future production at risk. The hurricane not only physically destroyed orchards but also interfered with logistics and infrastructure. Harvesting activities were hampered by power outages, and logistical bottlenecks were caused by damaged roads and equipment. These elements added to the growers' already substantial losses.

In addition to Hurricane Helene's immediate effects, the pecan sector is still dealing with more significant problems. Extreme weather events are becoming more common due to climate change, which is a persistent hazard. Growers are additionally burdened by economic issues such as fluctuating markets and growing input costs. Inefficiencies in the sector have also been exacerbated by labour shortages during seasons of high harvest.

Price fluctuation of Pecans in 2024

According to USDA reports, pecan growers in Georgia and Texas—two of the largest pecan-producing states—have faced challenges such as harvest disruptions due to unfavourable weather conditions like storms. These elements, along with labor shortages and increasing logistics expenses, have impacted prices at both the farmer and market levels.

Changes in export dynamics and rising international demand, particularly from Asia and Europe, have also influenced the global pecan market. Despite variations in harvest numbers, this demand and reduced production in some regions have kept prices relatively high.

High demand and supply constraints caused by unfavourable weather conditions have significantly impacted pecan prices in 2024. Growers in Georgia and other major pecan-producing areas have observed that prices vary greatly based on the size, quality, and variety of pecans. For example:

- High-Quality Types: Premium pecans like Desirables and Stuarts have sold for between $2.50 and $3.00 per pound of in-shell nuts at farm gates.

- Lower-Grade Pecans: Prices for smaller or lower-quality pecans have ranged from $1.50 to $2.00 per pound, reflecting quality-based variations.

- Retail and Wholesale Prices: Depending on market demand, wholesale prices for shelled pecans have varied from $5 to $8 per pound, while consumer retail prices in some markets have frequently exceeded $10 per pound.

These factors collectively contribute to the dynamic pricing landscape for pecans in 2024.

Conclusion

In 2024, the U.S. pecan industry faced numerous challenges, including extreme weather events, labor shortages, and rising logistics costs. However, advanced farming techniques and technological innovations have helped maintain stable production levels. The high demand for pecans, both domestically and internationally, has kept prices relatively high, reflecting the resilience and adaptability of the industry. Looking ahead, the U.S. pecan industry is well-positioned for growth. However, it will take time to recover from Hurricane Helene. It may take decades to restore and replant damaged orchards, especially if the trees are mature and essential for high yields. In the meantime, programs such as the "Weathered but Strong" relief fund are designed to assist farmers in reestablishing their businesses.