A large quantity of energy may be obtained from cashews, which are a concentrated and very nutritious dietary source. The cashew nut kernel can be eaten raw, fried, occasionally salted, or sweetened with sugar, and it has a nice flavor. In addition to being used as savory or sweet snacks, as components in sweets and savory meals, and as a spread, sauce, bar, and beverage ingredient, cashew nuts are further processed to create cashew butter.

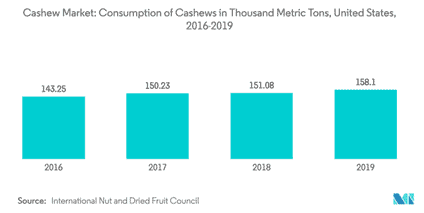

The demand from the cashew processing industries and the health advantages of cashew intake are the main factors driving the market in the nation. Several states, including California, Florida, New York, Texas, and New Jersey, have high cashew consumption rates. Consumers have started including cashew nuts in their diets recently, as a snack and a component in other foods. The purported health advantages of cashews, such as their rich nutritional content, which includes healthy fats, protein, and fiber, are one of the elements driving this trend. Additionally, cashews are a flexible component that may be utilized in a variety of ways, including as a dairy substitute in goods, like yogurt, with cashew butter. This is popular, especially among younger and health-conscious customers. Overall, the consumption of cashews is predicted to rise further due to the rising health advantages of nuts in general and cashews in particular. This has resulted in the expansion of innovative cashew-based products.

Due to its citizens’ growing health concerns, the United States consumes the most cashew nuts, followed by Germany, the Netherlands, China, the United Arab Emirates, and the United Kingdom. Cashews may be planted only in South Florida, Hawaii, and Puerto Rico since it needs a tropical climate free of frost. In the U.S., there is no commercial production, which increases global imports to meet the growing demand. However, cashews are cultivated in certain private gardens and also botanical gardens. The United States Cashew Market size is estimated at USD 3.77 million in 2023 and is expected to reach USD 4.37 million by 2028, growing at a Compound annual growth rate (CAGR) of 3% during the forecast period (2023-2028).

Source- US Cashew Market Size & Share Analysis - Industry Research Report - Growth Trends (mordorintelligence.com)

The U.S. Cashew Market is anticipated to see a CAGR of 3.1% from 2020 to 2025. The COVID-19 pandemic has had a direct and negative impact on the cashew market in the United States. Due to the closure of cashew factories, value-addition activities were affected negatively, which resulted in the rise of cashew prices, and due to the small amount of cashew production in the United States, imports are necessary to satisfy consumer demand. With 98 thousand metric tons of cashew kernels imported in 2019, the United States was the world's top importer. Despite this, there were very few imports of cashews in their shells. For most of its cashew imports, the United States is reliant on Vietnam, Thailand, and India. The demand from cashew processing companies and the health advantages of cashew intake are the main market drivers.

With 1.2 million dollars, Vietnam accounted for the largest portion of import value in 2019. Honduras and India come next with 66,000 and 4,000 dollars, respectively. About 679 thousand dollars worth of cashews were exported from the nation in 2020, primarily to South Korea, Jamaica, Canada, and Trinidad & Tobago. The United States also imported cashews from Côte d'Ivoire and Honduras. As the U.S. largely imports shelled cashews, in-shell cashew imports are quite low in the nation. The United States cashew import market is primarily driven by strong demand from direct consumers and the cashew milk processing businesses there.

The cashew market is anticipated to reach USD 8.91 billion by 2028, rising at a CAGR of 3.31% over the forecast period (2023-2028). It is now valued at USD 7.57 billion.