Fruit production is rising all over the world, and this commodity is valued not just for its flavor but also for its beneficial benefits on human health. Fruit crops account for a significant portion of agricultural output. Bananas, apples, and grapes are the most popular fresh fruits globally in order of production volume. Apples and bananas are grown on trees, whereas watermelons and grapes are cultivated on thick vines.

Fruits and vegetables are regarded as important components of a healthy and balanced diet. The United States Department of Agriculture (USDA) and the United States Department of Health and Human Services (HHS) advocate increasing fruit and vegetable intake in the Dietary Guidelines for Americans, which are prepared and published every five years. The United States is a major producer of fruits and vegetables. Non-citrus fruits alone occupied over 1.8 million acres of bearing area in the United States in 2020, with citrus fruits occupying approximately 668 thousand acres in 2021. In 2019, Mexico and Canada received the vast bulk of U.S. fruit exports. Grapes make up a significant portion of the total fresh fruit produced in the United States. In 2020, just less than six million tons of grapes were produced, worth around 4.8 billion US dollars. Oranges, apples, strawberries, and lemons are among the top fruit kinds in the United States.

Grocery shelves and restaurant kitchens in the United States are supplied with fruits that were formerly consumed only during certain seasons or by a smaller percentage of customers. Fresh fruit has played a larger role in the expansion of U.S. agricultural imports than any other horticulture product category in the recent decade, owing to easier access provided by trade agreements, increasing disposable income from 2009 to 2019, and interest in a wider range of products.

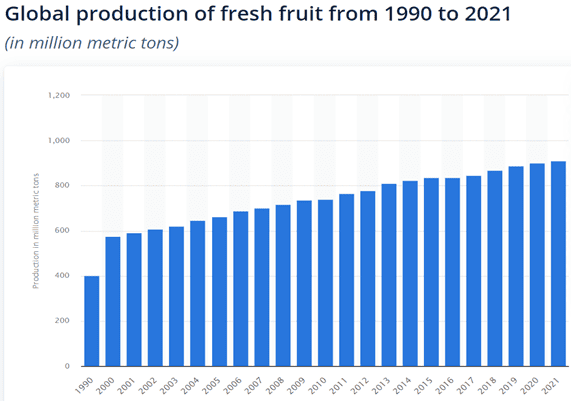

Source-Fresh fruit production worldwide 2021 | Statista

According to data from the United States Department of Labor's Bureau of Labor Statistics (BLS), retail prices for fresh fruit in the United States increased compared to the previous year, raising the Consumer Price Index (CPI) during the first two months of 2023. Lower supply, like lower producer prices, is driving up apple and strawberry retail prices. Apples and bananas are two of the fresh fruit CPI's most highly weighted prices, accounting for around 29 % of the index's relative importance—roughly the same as all citrus fruit.

Oranges The retail price of navel oranges in February 2023 was $1.55 per pound, a 7.2 percent rise from February 2022. Total orange output in the United States is expected to be 25% lower this season (November 2022-October 2023) than the previous year (2021/22). This drop is the result of an unparalleled year-over-year drop in Florida's Valencia and non-Valencia harvests, which fell by 56 and 66 %, respectively. The combined orange production in California is expected to rise by 14 % (228,000 tons) in 2022/23 due to a higher non-Valencia crop. However, California's Valencia orange crop is expected to be 6% (20,000 tons) lower than last season's total output. Despite the predicted year-over-year rise in the California orange harvest, total output is expected to be lower than the previous ten-year average for California oranges (2 million tons).

To compensate for decreasing output, imports of orange juice into the United States are likely to rise over last year, reaching more than 550 million single-strength equivalents (SSE) gallons. If accomplished, this will be the greatest amount of orange juice imported in at least fifty years. Mexico and Brazil are predicted to continue to be the primary providers of orange juice imports into the United States, accounting for 90 %of total imports in 2021/22. Given lower expected orange juice production volumes in Mexico and Brazil in the 2022/23 season, Costa Rica, Spain, and South Africa may make slight gains in their share of US orange juice imports this season.

Grapefruit Domestic grapefruit juice output is estimated to be 14.6 million (SSE) gallons in 2022/23. If accomplished, this would be the lowest level of grapefruit juice output in at least fifty years. Imports of grapefruit juice are likely to treble from the previous season as a result of lower forecast production levels.

Fresh lemon Imports are normally strongest at the start of the season (August through October), therefore overall imports are anticipated to stay below 2021/22 levels. Exports are also down year over year this season. Per capita, availability is projected to be 4.5 pounds per person.

Tangerine Output in the United States, which includes tangerines, mandarins, and tangelos, is expected to reach 904,000 tons in the 2022/23 season. This amount, if reached, will be 24% greater than the ultimate output levels in the 2021/22 season (November-October).

Apple Despite a 3% increase in the United States 2022 apple production forecast (USDA, NASS), a 4% decline in Washington State production is expected to contribute to a drop in export volumes during the 2022/23 marketing year (August-July). Fresh apple export volume in the United States fell 12% in the first six months of the marketing season (August-January) compared to the previous year’s period.

Avocado The California Avocado Commission (CAC) forecasts 257 million pounds of avocado output in 2023. If achieved, California avocado output would be around 5% lower than earlier forecasts for 2022, due to the tree's alternate-bearing nature, in which a year of higher production tends to follow a year of reduced production.

Strawberry According to the USDA, fresh strawberry shipments from Mexico amounted to 53% of the national volume in the first two months (nine weeks ending March 4, 2023). Strawberry f.o.b. shipping-point costs in the United States averaged $2.99 per pound in January 2023, up 29 % from the previous year. Prices stayed generally higher than a year ago through February and into March, as California producers battled to overcome the impact of chilly, rainy weather.

Fresh fruit import values are predicted to increase by $200 million in FY 2023, reaching $18.3 billion. Fresh fruit projection volumes have been revised upward from the prior prediction, and combined with rising unit prices, import values are anticipated to reach $18.1 billion in FY 2022.