The inflation rate is a measure of inflation, the rate at which a price index rises. It is the percentage rate of change in the price level over time. Inflation is typically measured and stated as a percentage and can indicate a loss in the purchasing power or worth of a country's currency. The development of a country's Consumer Price Index (CPI) is one of the most important economic indicators. The rate of inflation is defined as the change in the price level of goods and services.

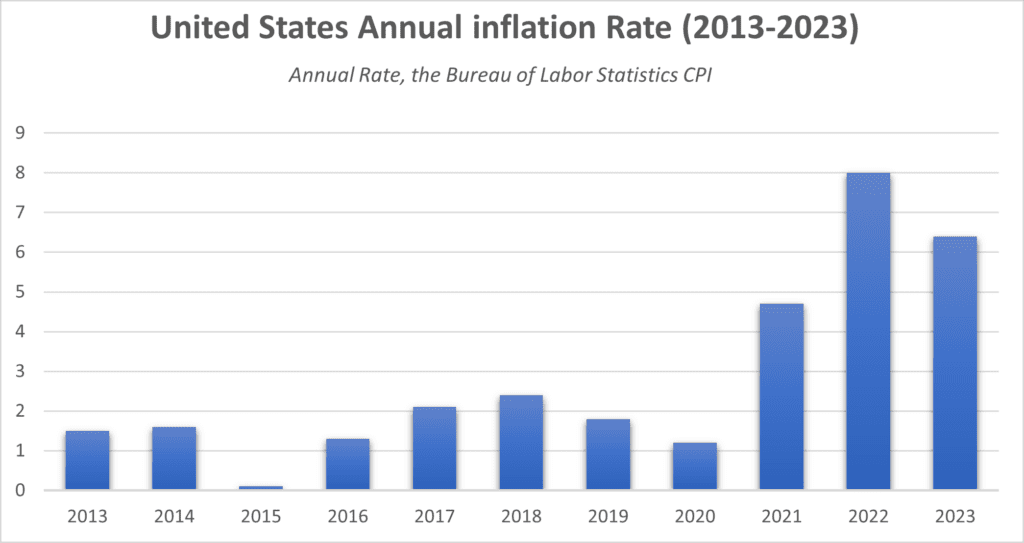

Due to global events such as COVID-19, supply chain constraints, and Russia's invasion of Ukraine, the inflationary situation in the United States has been relatively severe in 2022.

According to U.S. Labour Department data issued on Feb. 14, the annual inflation rate in the United States is 6.4% for the 12 months ending January 2023, up from 6.5% before.

Inflation impacts all areas of the economy, most notably the agricultural sector. Inflation affects both producers and consumers. In the case of agriculture, historical data confirms the premise that commodity prices often rise during periods of inflation.

Increased interest rates can also have an influence on land prices, currency rates, and total family living expenditures, all of which have an impact on the broader economy and indirectly impact the boon of the economy i.e., the agricultural sector and the producers.

Inflation is defined as an increase in agricultural commodity prices that affects the economy by diminishing consumer purchasing power and causing producers to earn less revenue. Inflation also raises the rate of unemployment or labor shortages. From 2021, as the global economy recovered from COVID-19 lockdowns, commodity prices have started increasing. Wheat, corn, maize, and sunflower oil prices, all experienced further increases because of the Russian invasion of Ukraine. Input costs are still high because of the significance of Russian exports and fertilizer production. Likewise, other fertilizer companies' capacity to grow has been constrained by Europe's high natural gas prices and supply uncertainties. Producers generally prefer inflation to be low and stable. If inflation rises above 3 or 4%, firms may see a rise in costs and uncertainty. Inflation can also cause firms problems of rising costs, falling profitability, and a decline in international competitiveness.

Now, farmers are noticing the effects of inflation in four key areas: Fuel, labor, seeds, and fertilizers - which is the worst impacted.

Fuel: As fuel is a significant agricultural input as it is used in tractors, machinery, and other equipment used in farming, an increase in fuel prices affects inflation, which tracks the total rate of price growth across the economy. Furthermore, crude oil is also essential in agriculture as it is the main origin of the pesticides and fertilizers that are used for chasing away pests and for the proper growth of plants.

Labor shortages: This can result in inflationary pressure. Workers can demand greater compensation if businesses are having trouble filling positions with qualified candidates. This has the potential to quickly result in rising wages, which raises prices.

Seeds: Supply chain problems and inflation are affecting virtually every commodity at every level. Fresh produce, fruit, and vegetable prices have risen at different rates, due to a combination of factors such as a hike in seed prices due to inflation.

Fertilizers: High fertilizer costs cause food prices to rise, raising concerns about food security at a time when the COVID-19 epidemic and climate change are making it harder to get access to food and also contributing to inflation in the economy.

Sadly, experts say that there aren’t many farmers can do to avoid it but they can take efforts to control it. New machinery, land upgrades, maintenance, or fertilizer application frequency, careful expenditure, and detailed preparation are the golden rules to live by.

Forecast-

After increasing by 0.1% in December, inflation increased by 0.5% in January, according to the Consumer Price Index released last week. Rising housing, gas, and oil prices are the constraints that affected consumers in 2023, which led to an increase in inflation.

The Federal Reserve is attempting to reduce inflation without significantly affecting employment. Nonetheless, the most recent CPI figures indicate that the Fed will probably continue raising rates into next year. According to former Boston Fed President Eric Rosengren, the US is most certainly going to experience a minor recession in 2023.