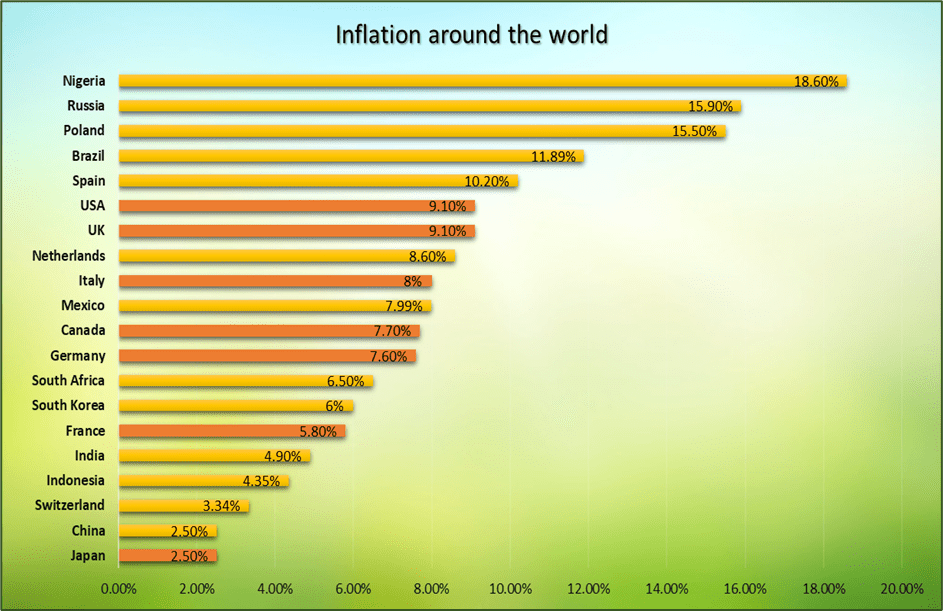

The rate of inflation has risen dramatically all over the world economy. As the world emerged from the pandemic, it saw a rapid increase in inflation, especially over the last year. According to the 12-month percentage change in the consumer price index, the monthly inflation rate for goods and services in the U.S. increased by 8.5% in July 2022, compared to July 2021.

The sudden hike in inflation is the effect of China’s lockdown and the Russia-Ukraine war. Since China is the biggest exporter of goods and Russia is one of the largest suppliers of oil, a lack in the production and distribution of these is the main reason for a hike in consumer prices. Countries across the globe are being hit by higher commodity prices, causing lower real incomes, lower growth, and fewer job opportunities worldwide. The Russia-Ukraine war is resulting in more alarming levels of inflation throughout the globe.

Surging prices will affect the majority of the population across the globe, particularly in low-income countries. Consumers will experience the impact of soaring prices of essential commodities such as food and fuel in their daily lives, thus diminishing their purchasing power. High overall inflation will also complicate the trade-offs between central banks regarding containing price pressures and safeguarding growth.

Furthermore, constant increases in food and energy prices and persistent supply-chain blockages are other key factors causing consumer price inflation to rise. In some advanced economies, inflation is now expected to reach levels not seen since the 1970s.

Countries must do everything in their power to bring down high inflation. If the rate of inflation continues to rise, the global economy will ultimately fall and affect the GDP adversely.

Governments around the globe have come up with a few ways to bring down inflation. The first, go-to method is rise in interest rates. However, raising the interest rates and keeping them higher for a longer period would also lower economic growth and lead to an increase in unemployment.

Raising interest rates increases the costs of borrowing which reduces inflation by slowing the economy. When rates go up, fewer people take out loans for things like buying a home or starting a business. Then, demand reduces for homes, employees, and other goods and services. Eventually, the prices fall and slow down inflation.

The primary policy for reducing inflation is monetary policy – in particular, raising interest rates reduces demand and helps to bring inflation under control. However, if inflation is left unchecked, it can lead to a significant loss in purchasing power. To help keep inflation rates manageable, the Fed watches certain inflation indicators such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). When these indicators start to rise more than 2% to 3% a year, the Fed will raise the federal funds rate to keep the rising prices under control. Other policies to reduce inflation can include tight fiscal policy (higher tax), supply-side policies, wage control, exchange rate appreciation, and control of the money supply (a form of monetary policy).

The US government can use fiscal measures to invest in reforms to expand the size of the labor force, improve productivity, and incentivize innovation and investment. These can include increased government support for paid family leaves, childcare, pre-school, and access to a college education. Other reforms can be tax credits that help women, minorities, and lower-income workers join the workforce; and immigration reform that is targeted toward expanding the labor force and strengthening skills.

-Prashansha Yadav